accounting for lottery sales|Lottery Sales and Inventory : Tuguegarao Typically, lottery sales are subject to state and local sales taxes, which must be collected at the point of sale and remitted to the appropriate tax authorities. Accurate record . Watch Pinay Iyutan porn videos for free, here on Pornhub.com. Discover the growing collection of high quality Most Relevant XXX movies and clips. No other sex tube is more popular and features more Pinay Iyutan scenes than Pornhub! Browse through our impressive selection of porn videos in HD quality on any device you own.

PH0 · Six Best Practices for Using a POS to Sell Lottery

PH1 · Recording lottery sales in QuickBooks (Online)? : r/Accounting

PH2 · Recording lottery sales in QuickBooks (Online)?

PH3 · Proper way to record Lotto sales, commission and payouts

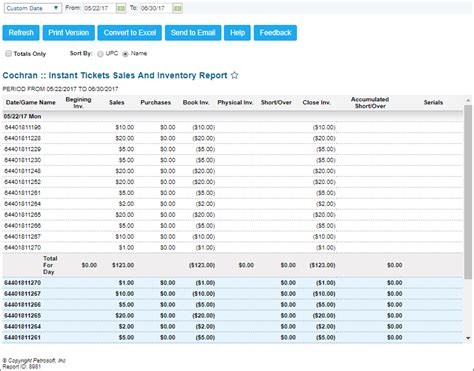

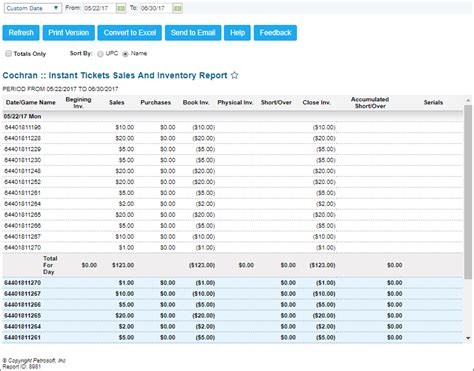

PH4 · Lottery Sales and Inventory

PH5 · How do I enter Lottery sales in Reckon Accounts?

PH6 · Everything you need to know about the Oasis reunion

PH7 · Bookkeeping Best Practices for Lottery Sales Transactions

PH8 · Anyone do bookkeeping for a store that sells Lottery Tickets

PH9 · 6. Lottery ticket sales

Commercial or Pre-built Electronic Workstation Option. For the non-DIY person, there is a pre-built workstation option available. Here at Ezad Lab Furnishing, we provide users with an easy method of building the perfect workstation right from your computer or smartphone. Easily select the workbench material, height, frame color, and accessories.

accounting for lottery sales*******I am looking for the correct way in Quickbooks to make a "sales receipt" ( with the correct +/- assignments ) and the proper accounts in the COA to record these amounts without them being income. I need to track the GROSS LOTTO IN less the validated PAYOUTS, the .Ticket Sales: There are two parts to the sales of actual tickets. Printed tickets - these are for games where the lottery commission system generates a ticket and records the sale . Typically, lottery sales are subject to state and local sales taxes, which must be collected at the point of sale and remitted to the appropriate tax authorities. Accurate record . dr lottery fund. cr commission. Pay camelot: dr lottery fund. cr cash. If the fund was some kind of reserve account it would clear down every time commission had been paid . This video presents the process of accounting for lottery sales and paid outs. Watch Video. Viewing Lottery Inventory. You can view the lottery sales and inventory in the following ways: For a specific date and shift — at .. Why Do You Need Best Practices When Selling Lottery Through a POS? The goal of establishing best practices for using a POS system to sell lottery tickets is to improve the tracking and transparency of the lottery category. This will help .

I need to enter Lottery sales into Reckon Accounts Premier. I receive an RCTI from the Lottery detailing gross turnover, payouts, commissions, and fees. They then sweep my account for the . Learn more about bookkeeping, how it differs from accounting, the required qualifications, and bookkeeping jobs and salaries. Now you know some best practices for . The actual service of selling lottery tickets is exempt. 6.2 Is a retailer required to account for tax on commission? No. If a retailer sells lottery tickets as an agent for either a .

When are the dates for Oasis' reunion tour? And how much will tickets be? Here's everything we know so far.accounting for lottery sales Lottery Sales and Inventory A reliable, automated solution for creating daily lottery and back-office reports. Managing a convenience store is anything but convenient. Many store owners struggle to track lottery inventory accurately and manage cash .The Lottery’s accounting week is Sunday through Saturday. On Sunday, you can print for the prior week’s activity (Weekly settlement report) and all scratch tickets that have . *If packs are not activated due to exceptions, please contact your Lottery Sales Representative or Lottery Customer Service to have the pack status checked or .Lottery Sales and Inventory 6. Lottery ticket sales 6.1 The liability of the service of selling lottery tickets. The actual service of selling lottery tickets is exempt. 6.2 Accounting for tax on commission if you’re a .

The accounting, particularly by local Post Offices, for lottery money (including scratchcard sales) is a nightmare! You may find apparently contradictory information being generated by the PO Horizon accounting system and the Camelot terminal. Good luck with that! David. Thanks (0) Accounting rules for revenue recognition classify ticket sales as a benefit—or proxy for revenue—that you should record as a liability until redemption. That unearned revenue obligates your business to hold the event or perform the service associated with those tickets at some point in the future.

The COGS and sales for online lotto should always match. Following these steps will help you manage your lottery accounting efficiently and ensure your store remains financially healthy. Scratch-off Sales (scratchers) Scratch-off tickets or instant ticket sales follow a different process.

accounting for lottery salesFor Traditional Lottery sales only – your business must be open and selling something. For Video Lottery sales – your business must qualify to apply for selling Video Lottery. . You can also request special refresher training or training on specific topics (e.g. increasing sales, accounting, etc.) by contacting your Field Sales . Foyer is a secure client portal service designed for accounting, bookkeeping, and tax preparation protect your sensitive information. With end-to-end encryption, multi-factor authentication, and authorization controls, we ensure your firm's documents stay safe. Try out Foyer free for 14-days, no commitment necessary.The service of selling lottery tickets is always an exempt supply. However, it is important to know in what capacity a person is selling the tickets, in order to establish who is to be attributed .

Keeping an accurate track of lottery inventory is one of the best ways to see the benefit of lottery sales to your bottom line. If you need additional assistance in accounting for your lottery sales, ask your Sales Representative for help or contact Retailer Services at 1-877-382-4530, Option2.

If he paid $80,000 for non-cash prizes for October, he would include his gross gambling sales of $100,000 at G1 (total sales) on his October activity statement. He would then include the $80,000 he paid for non-cash prizes at G10 (capital purchases) or G11 (non-capital purchases), depending on whether the prizes were capital or non-capital items.This video presents the process of accounting for lottery sales and paid outs. Watch Video. Viewing Lottery Inventory. You can view the lottery sales and inventory in the following ways: For a specific date and shift — at the top of the page, select the date and the shift you need.

Sales Definition and Explanation of sales revenue. Generation and impact of sales revenue on the equity. Recognition of sales revenue. Sources of sales revenue. Accounting for cash and credit sales with illustrative examples.Accounting Practice Sales - Specializing in matching owners with qualified buyers nationwide. Buy, sell and valuate CPA firms, tax business and practices. Connect; 877 632 1040; 877 632 1040; Free Valuation; VIEW PRACTICE LISTINGS; LOG IN LOG IN FRANÇAIS; Sellers .The entry will increase advertising expenses $ 5,000 and reduce inventory by the same amount. Advantages of Promotional Giveaways. Increase sales: The promotion will increase the sale as the customers are hooked on the product. With the high quality, the customers will come back and purchase more after trying the promotional items.Agency management must ensure the proper accounting and reporting of lottery moneys received by their agency. Agencies must account for transactions related to lottery moneys in accordance with generally accepted accounting principles. PROCEDURE: 102. The State Lottery Fund shall receive all proceeds from the sale of lottery tickets or shares, and

It will not be related to the cash received as the accounting follow the accrual basic. The revenue will be recorded when the company delivers goods or services to the customer. In this situation, they can record revenue when the event takes place, the customer has experienced it. . The sale of tickets in advance is considered unearned .

Hisably is an easy-to-use Cloud-based Accounting software App for convenience stores, c-stores, gas stations, and other retailers. Try a Free Demo Now! . Don’t count lottery ticket sales manually – scan them and have Hisably calculate your daily sales per shift. Manage lottery book inventory with ease using any standard barcode scanner.

私信列表 所有往来私信. 财富管理 余额、积分管理. 推广中心 推广有奖励. new; 任务中心 每日任务. new; 成为会员 购买付费会员. 认证服务 申请认证. new; 小黑屋 关进小黑屋的人. new; 我的订单 查看我的订单. 我的设置 编辑个人资料. 进入后台管理

accounting for lottery sales|Lottery Sales and Inventory